Understanding your Credit Report

Your credit report reflects your financial condition. By learning to interpret a credit report, you can acquire a deeper insight into your financial health. Although it might appear challenging to analyze a credit report, simplifying the data contained within your credit reports is easier than it seems.

Essentially, your credit report is an exhaustive summary of your credit history, used to calculate your credit score and inform financial decisions by creditors and financial institutions. The most valuable tip regarding credit reports? Grasp the fundamentals of reading credit reports and annually verify for inaccuracies.

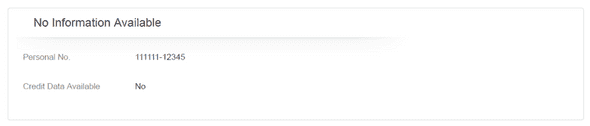

Personal Information

This information is used to verify your identity. Used by KIB, lenders and banks. If any of this information is incorrect then it must be updated immediately.

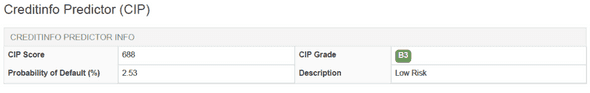

Creditinfo Predictor (CIP)

The Creditinfo Predictor is a result of the analysis of all the subject's credit related information which is stored in the database of the credit bureau. It is meant to shorten the information by summarizing it into a single number that is represented both qualitatively and quantitatively. The CIP Score is the quantitative measure which ranges from 250 to 900 where higher number is referred to the lower risk.

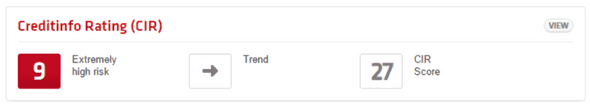

Creditinfo Rating (CIR)

The Creditinfo Rating is a result of the analysis of all the company's credit and business related information which is stored in the database of the credit bureau. It is meant to shorten the information by summarizing it into a single number that is represented both qualitatively and quantitatively. The CIR Score is the quantitative measure which ranges from 0 to 130 where higher number is referred to the lower risk.

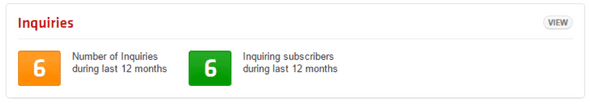

Inquiries

Credit report also provides information about number of inquiries made by financial institutions during specified time period and number of different financial institutions (subscribers ) who made an inquiry on the subject during specified time period. This information is also one of the factors when counting the final score. The indicator with a number of inquiries can be one of three different colours: green, orange and red, the latter means that there were too many recent inquiries and serves as an alert of a potential fraudulent behavior.

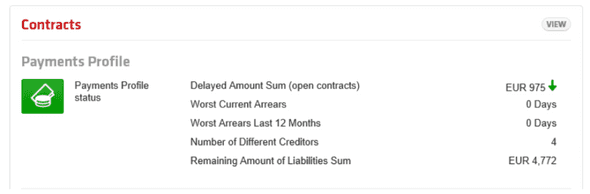

Contracts

The Contracts section is a brief summary on the payment profile status of all the credit facilities linked to a borrower. It is a quick guide into a negative payment status of a particular account. After assessing the score, a lender may want to look at the specific contracts the subject of the report has entered into. The Payments Profile is aimed to display a summary of the relevant negative information on all loan contracts and is a useful tool a lender may use to make a decision whether investigating further each contract or not.

Collaterals

The collaterals section is a short summary of currently used collaterals for all the contracts the subject is involved to.

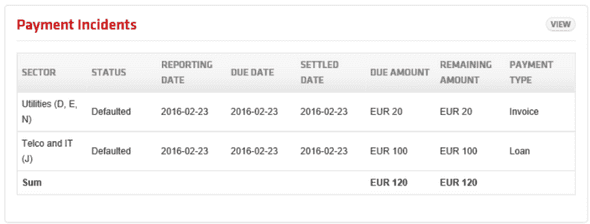

Payment Incidents

This block includes information about delayed payments (invoices, rents, loans) reported by utilities, telecoms or other non-financial institutions.

Relations

The Relations block on Dashboard is showing if the subject is connected with any other subjects being a codebtor, guarantor, CEO, employee etc. More detailed information can be found in the Relations tab.

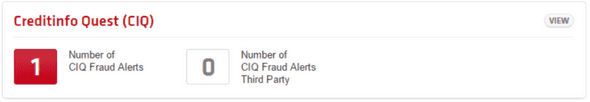

Creditinfo Quest (CIQ)

Creditinfo Quest block represents information which is relevant according to the system in the meaning of a possible fraud. The CIQ includes information about inquires made during last 48 hours or 14 days as too many inquires might look suspicious, Lost/Stolen documents information in case such information is accessible and data about contracts closed with the status "canceled" which means that a loan was taken by a fraudster but found out and canceled by the financial institution.

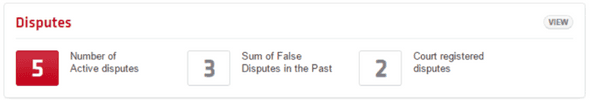

Disputes

Disputes block shows summary information about the claims about any errors on inconsistencies on the report.